Thailand and Beyond: A Regional Blueprint for Medical and Wellness Tourism in ASEAN

The global wellness tourism market is experiencing extraordinary growth—and Southeast Asia is poised to lead. Even before the COVID-19 pandemic, travelers were seeking vacations that enhanced their well-being. In 2019, the Global Wellness Institute reported wellness tourism expenditures reached a record $720 billion (Global Wellness Institute, 2019). Though the pandemic caused a temporary disruption, the rebound has been swift and decisive: by 2022, global expenditures had surged to $817 billion and are projected to reach $1.3 trillion by 2025 (Global Wellness Institute, 2023).

Southeast Asia is riding this wave. According to Jing Daily’s China Health and Wellness Report 2024, wellness tourism in Asia grew by 28.4% from 2022 to 2023—totaling approximately $41 billion in regional spending (Jing Daily, 2024). Meanwhile, Global Market Insights Inc. estimated that the ASEAN medical and wellness tourism market was valued at $51.5 billion in 2023, with projected annual growth exceeding 12% (Global Market Insights, 2024).

This trajectory presents a unique opportunity. As international travel rebounds, health-conscious travelers are increasingly turning to Asia—and particularly Southeast Asia—for preventive healthcare, rejuvenation, and holistic well-being.

Why ASEAN is Uniquely Positioned

Southeast Asia offers a distinctive blend of natural beauty, cultural richness, and healing traditions. Countries like Thailand, Vietnam, Cambodia, Indonesia, and Laos seamlessly combine local wisdom with contemporary wellness offerings. Wellness travelers enjoy more than just medical check-ups or spa treatments—they are immersed in deeply rooted cultural experiences, from traditional Thai massage (recognized by UNESCO) to Balinese jamu herbal therapy, Vietnamese steam baths, and Filipino Hilot healing (UNESCO, 2019).

The region’s pristine natural environment supports trends like “sleep tourism” and “spiritual retreats,” creating immersive, restorative wellness experiences (Grand View Research, 2023).

Thailand: A Leading Example of Wellness Tourism Policy

Thailand offers a case study in national leadership and strategic planning. The country’s 20-Year National Strategy (2018–2037) and Medical Hub Policy Strategy (2017–2026) explicitly position it as a global health and wellness destination (Royal Thai Government, 2018; Ministry of Public Health, 2017).

Before the pandemic, Thailand hosted 3.5 million international medical travelers annually, generating $820 million in revenue (International Trade Administration, 2020). In 2023, the sector rebounded with 120% growth, reaching $12.34 billion in revenue (Charter of Health, 2023). Thailand now ranks 5th globally in medical tourism (Grand View Research, 2023), with over 60 internationally accredited hospitals (Healthcare Accreditation Institute, 2024).

Challenges Facing SMEs in the ASEAN Wellness Sector

Despite strong national performance, wellness tourism is still largely driven by small and medium-sized enterprises (SMEs). In Thailand, over 95% of health and wellness tourism providers are SMEs, yet they capture just 20% of total market value (LH Bank, 2024).

These SMEs face critical challenges:

• Limited access to finance

• Lack of global marketing and digital expertise

• Inconsistent service quality

• Fragmented, short-term government support

These structural issues are common across ASEAN (OECD & ERIA, 2024). Without targeted, long-term policy support, many small wellness providers will struggle to grow or sustain their operations.

TMWTA’s Role in Supporting SME Competitiveness

The Thai Medical and Wellness Tourism Association (TMWTA) partners with Global Healthcare Accreditation to deliver professional training such as the Certified Medical Travel Professional (CMTP) course (Global Healthcare Accreditation, 2024). We also collaborate with the Thai Lifestyle Medicine and Wellbeing Association (T.L.W.A.) to promote service innovation in lifestyle medicine.

TMWTA organizes the annual Wellness & Travel Fair and promotes value-chain integration—where multiple SMEs deliver complementary services marketed as a single experience. We also represent SMEs in policy dialogue through partnerships with OSMEP, ISMED, and TAT.

A Vision for ASEAN Leadership

To elevate ASEAN’s global standing in wellness tourism, we propose the following coordinated regional actions:

1. Develop Joint ASEAN Wellness Itineraries

Create multi-country experiences under an “ASEAN Wellness Journey” brand.

2. Align Standards and Accreditation

Expand the ASEAN Spa Services Standards to cover broader wellness services (ASEAN Secretariat, 2018).

3. Facilitate Wellness Travel Across Borders

Consider an ASEAN Wellness Visa or travel pass, and improve transport connectivity.

4. Create a Regional Marketing Platform

Launch a unified ASEAN wellness sub-brand, digital platform, and host regular regional events.

5. Leverage Existing ASEAN Frameworks

Integrate wellness tourism into ASEAN tourism and SME strategies.

Together, these steps will empower ASEAN to offer seamless, trusted, high-quality wellness experiences across borders—benefiting travelers and local communities alike.

Translated and compiled by ArokaGO Content Team

References

ASEAN Secretariat. (2018). ASEAN Spa Services Standards.

Charter of Health. (2023). Thailand’s Medical Tourism Growth Report. [www.charterofhealth.org]

Global Healthcare Accreditation. (2024). Certified Medical Travel Professional (CMTP) Program.

Global Market Insights. (2024). Medical and Wellness Tourism Market Size Report. [www.gminsights.com]

Global Wellness Institute. (2019). Global Wellness Tourism Economy Report.

Global Wellness Institute. (2023). Wellness Economy Report 2023.

Grand View Research. (2023). Medical Tourism Market Size, Share & Trends Analysis Report. [www.grandviewresearch.com]

Healthcare Accreditation Institute (Thailand). (2024). List of Internationally Accredited Thai Hospitals.

International Trade Administration. (2020). Thailand – Healthcare Services Overview. [www.trade.gov](http://www.trade.gov)

Jing Daily. (2024). China Health and Wellness Report 2024.

LH Bank. (2024). SME Insight: Thai Health and Wellness Tourism. [www.lhbank.co.th](http://www.lhbank.co.th)

Ministry of Public Health, Thailand. (2017). Medical Hub Policy Strategy (2017–2026).

OECD & ERIA. (2024). SME Policy Index: ASEAN 2024 – Towards Competitive and Innovative SMEs.

Royal Thai Government. (2018). 20-Year National Strategy (2018–2037).

UNESCO. (2019). Nuad Thai, traditional Thai massage. Retrieved from [https://ich.unesco.org/](https://ich.unesco.org/)

Share this article

More Articles

Discover more insights on health care and medical tourism.

How to Verify a Dentist’s License in Thailand

Thailand is one of the world’s leading destinations for medical and dental tourism, known for high-quality care, modern clinics, and competitive pricing. However, for expats and international patients, verifying that a dentist is properly licensed is a critical step before starting any treatment.

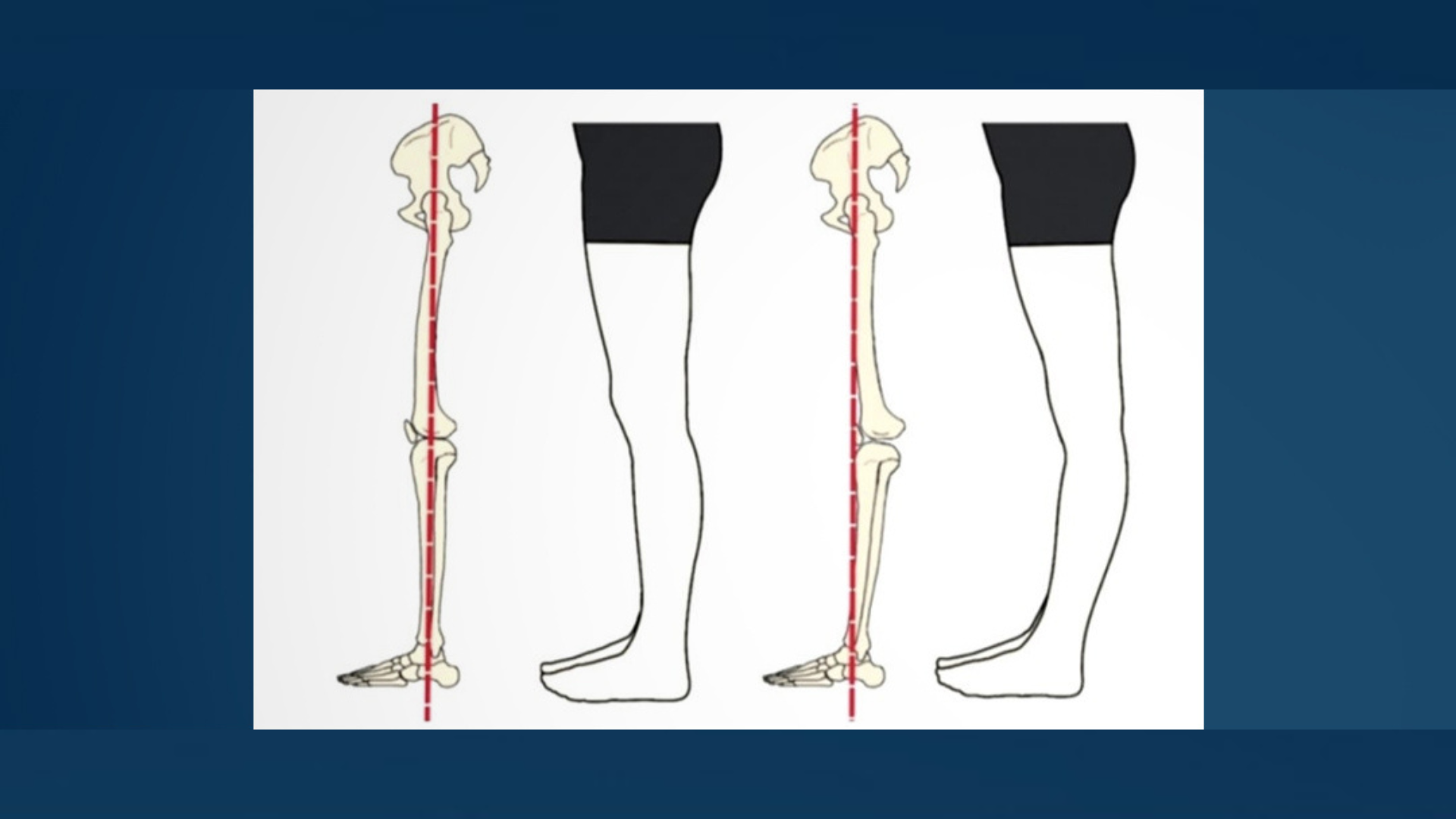

Why do some stroke patients with good leg strength still walk with knee hyperextension (genu recurvatum)?

This is a question I see repeatedly in clinical practice, and simple explanations based on “weakness” often fall short.

How to Overcome Chronic Pain After an Accident

Have you ever felt that your life changed from the day you were injured? Pain that lingers for years can make you afraid to do the things you love, hesitant to exercise and sometimes even walking becomes difficult.